According to VCBeat, recently, Kangpu Bio-Pharma Technology co., LTD. ("Kangpu Bio-Pharma") has completed Pre-B round financing of nearly 1.42 million dollars. This round is jointly led by Shenzhen Guozhong Venture Capital Management co. LTD (Guozhong Venture Capital) and Shanghai Furong Investment co., LTD. (Furong Investment), followed by current investor Northern Light Venture Capital (NLVC).

Headquartered in Shanghai Zhangjiang Hi-Tech Park, Kangpu Bio-Pharma is an innovative biopharmaceutical enterprise in the clinical stage. Focusing on cancer, autoimmune diseases, and inflammation, Kangpu Bio-Pharma holds proprietary technologies for generation and degradation of ubiquitin-protein and a new drug combination platform called X-Synergy®. Kangpu Bio-Pharma is committed to developing the world's new type I small molecules targeting immunomodulatory drugs to the world.

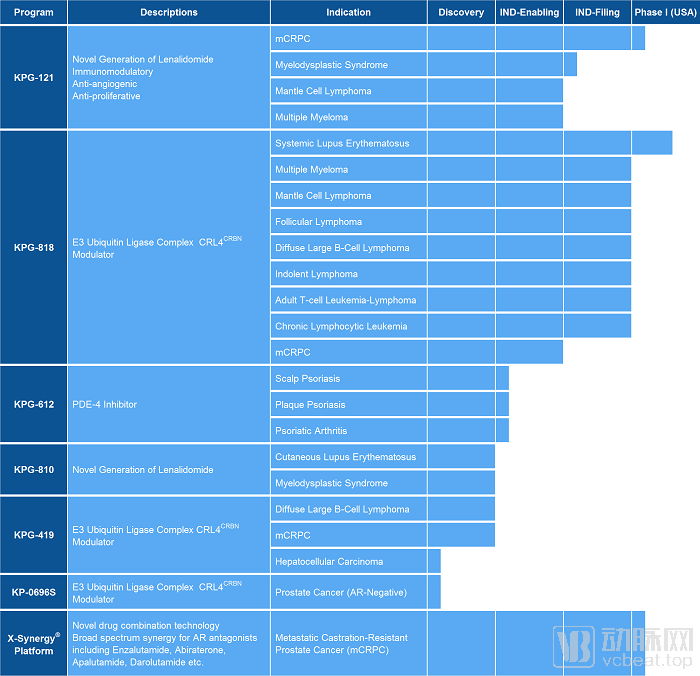

At present, the company has been established many pipelines for the treatment of prostate cancer, myelodysplastic syndrome, diffuse large B cell lymphoma, multiple myeloma, set of cell lymphoma, inert cell lymphoma, systemic lupus erythematosus (SLE), psoriasis, arthritis and other diseases areas, including candidate drugs with First - Class or Best-in-Class potential. Two candidate drugs have entered the stage of Phase I clinical trials.

"We are very honored to have Guozhong Venture Capital and Furong Investment to support us. This round of funding will be used for clinical trials and the preclinical development of other candidate drugs. We look forward to working with our investors to provide more effective treatments for patients worldwide." , the founder, chairman, and CEO of Kangpu Bio-Pharma,Dr. Gao Chuansheng said.

Guozhong Venture Capital said, "Overcoming resistance to existing drugs has become an important direction of new drugs. Those small molecule immunoregulatory targeted drugs developed by Kangpu Bio-Pharma provide a new way to achieve it. The pre-clinical data of those drugs is impressive. We are looking forward to the results of subsequent clinical trials. We will support Kangpu Bio-Pharma for the rapid development of Kangpu Bio-Pharma."

Furong Investment said, "The treatments of advanced prostate cancer, systemic lupus erythematosus, and various hematologic malignancies are in huge need that has not been fully met, especially in China. Kangpu Bio-Pharma’s drugs are more effective and safer, which will bring hopes to patients who have no treatments. We are very glad to cooperate with the excellent team led by Dr. Gao Chunsheng."

Kangpu Bio-Pharma's Pipelines

About Guozhong Venture Capital

Guozhong Venture Capital was founded on 21st of December 2015, currently being entrusted to manage the first entity fund of Small Medium Enterprises Development Fund(SHENZHEN)LLP with a size of 6 Billion Yuan.

Guozhong Venture Capital with a registered size of 100million Yuan, partners consisting of Shenzhen venture capital group (49%) and the management team of Small Medium Enterprise Development Fund (SHENZHEN) (51%).

About Furong Capital

Furong Capital is established by the Research Institute of Fudan University in Ningbo to support science and technology. Furong Qingyun Fund is established by Furong Capital focusing on early and middle-stage companies in the fields of life and health, intelligent manufacturing, and green technology.

About Northern Light Venture Capital (NLVC)

NLVC was founded by general partners Feng Deng and Yan Ke on January 1, 2005. Currently, it is managed by five Managing Directors. It manages approximately $ 1.5 billion in committed capital with 4 US$ funds and 4 RMB funds. NLVC is a China concept venture capital firm focused on early and growth-stage opportunities. So far, NLVC has invested in more than 200 portfolio companies and seed investments including Meituan, Thundersoft, BGI Genomics and so on.

提供支持

提供支持