According to dealstreetasia.com, China's genetic testing and medical diagnostic service provider GensKey has secured nearly 100 million yuan ($14 million) in a Series B round of financing from SB China Capital, Shanghai Lin Chong Investment Management, and Yuanju Capital.

The new funding follows a Series A investment by Legend Capital earlier this year.

GensKey was founded in 2017 and was born in the incubator of the school of life sciences of Peking University. The meaning of " GensKey (Gene's Key)" is that the purpose of the company is to apply gene technology to find the key to solve the problem of infection diagnosis. At present, the company's headquarter and its product research and development center are located at Changping Life Science Park in Zhongguancun, Beijing.

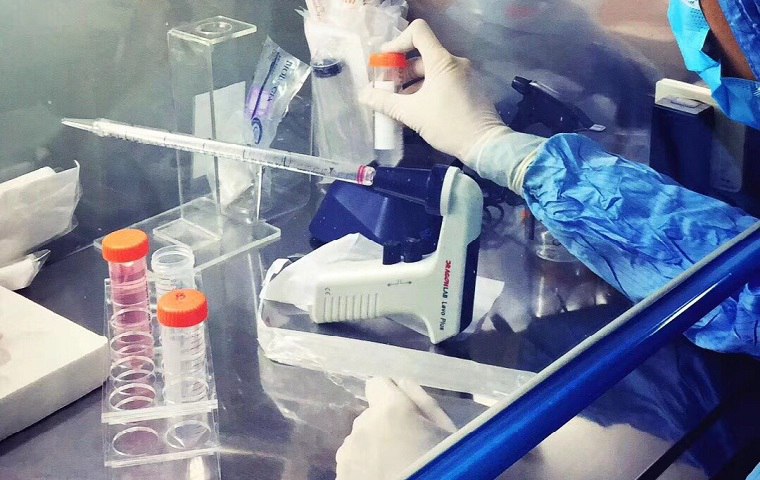

GensKey claims to use next-generation sequencing technology for pathogen diagnosis to ensure high detection rate, timeliness, and accuracy. Its flagship product is GenseqPM, which can detect any pathogenic micro-organisms.

Since its establishment, GensKey has grown rapidly, serving more than 100 hospitals, more than 1,000 doctors, and assisting over 10 central hospitals across China in the construction and operation of the high-throughput pathogen detection platform.

GensKey will use the proceeds to upgrade its medical laboratories in Tianjin and Shanghai, along with its research laboratories in Beijing and Guangzhou.

About SB China Capital (SBCVC)

Established in 2000, SBCVC is a leading venture capital and private equity firm that manages both USD and RMB funds. Its investment focuses on high-tech, high growth companies in TMT, clean technology, healthcare, consumer/retail, and advanced manufacturing sectors. The company invests across all stages of companies.

About Yuanju Capital

Yuanju Capital is an investment firm specialized in asset management, investment management, investment consulting, financial consulting and other fields.

提供支持

提供支持