According to 36Kr.com, Nanjing Legend Biotechnology Co., Ltd. ("Legend Biotech"), a subsidiary of GenScript (HK: 1548) (OTC: GNNSF) has recently received a $150 million strategic investment from Hudson Bay Capital, Johnson & Johnson Development Corporation, Lilly Asia Ventures, Vivo Capital, RA Capital, and others.

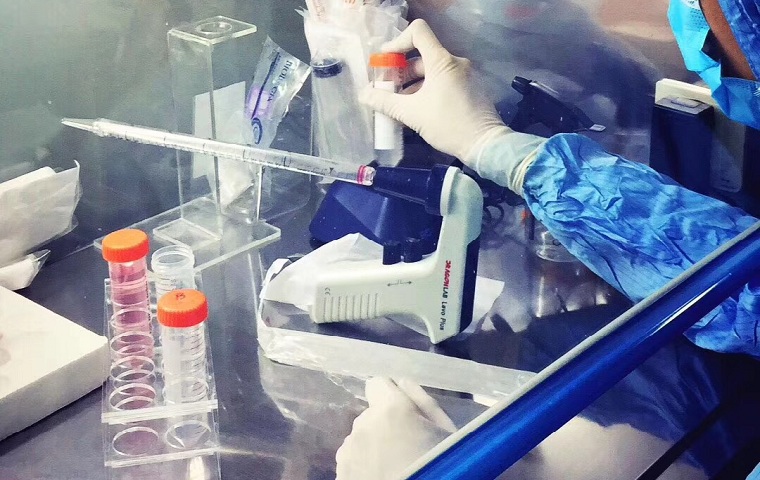

Founded in 2014, Legend Biotech is a multinational biopharmaceutical company focused on discovering and developing cutting-edge cell-based therapies. The company has developed the chimeric antigen receptor T (CAR-T) cell therapy targeting CD38 and B cell maturation antigen (BCMA) of multiple myeloma, using patients own immune cells, after in vitro genetic modification then injected back into the patient, to precisely targeted and kill tumor cells, mainly used in the treatment of leukemia and lymphoma.

Legend Biotech is utilizing the extensive cell therapy experience of our leadership and R&D staff, global clinical partners, and expanding research facilities to realize the potential of cell therapy to treat diseases that are thought to be incurable, such as hematologic malignancies, solid tumors, infectious diseases, and autoimmune diseases.

The first product candidate of Legend Biotech, LCAR-B38M, is a BCMA-directed CAR-T cell therapy. The novel dual-epitope design of the BCMA targeting domain facilitates tight binding to BCMA, which is highly expressed on primary myeloma cells and plasma cells. The company has cooperated with Janssen Biotech, Inc., one of the Janssen Pharmaceutical Companies of Johnson & Johnson, to develop and commercialize LCAR-B38M (JNJ-68284528) worldwide which has entered into a phase Ib/II study intended for registration in the US and EU.

Recently, Legend Biotech has filed for an IPO on a US exchange. Johnson & Johnson once partnered the treatment of Legend Biotech in a deal that paid Legend Biotech $350 million upfront, plus unspecified milestones and royalties.

About Hudson Bay Capital

Hudson Bay Capital is a multi-billion-dollar asset management firm operating in New York and London. With over 80 employees, it has been managing assets on behalf of outside investors since 2006.

JJDC is the venture capital subsidiary of Johnson & Johnson. JJDC is comprised of experts and leaders in the health care and technology venture communities who identify early market indicators, health care trends, and strategic investment opportunities. JJDC identifies new market opportunities and develops new businesses in emergent health care sectors.

提供支持

提供支持