According to dealstreetasia.com, Affiliates of Asia-focused private equity major Hillhouse Capital Group and others have picked up stakes in Shanghai Zerun Biotechnology Co., Ltd. ("Zerun") that specializes in novel human vaccine research and development.

Zerun wiped out 200 million yuan (US$29 million) of debt by giving more than 11.1 percent shares to a consortium of six companies: Affiliates of Hillhouse Capital Group, Chinese asset manager Yingke Innovation Asset Management, Shenzhen-listed contract research organization Hangzhou Tigermed, and others.

Walvax Biotechnology, the parent firm of Zerun, remains the largest shareholder in the biotech firm with a 65.14 percent stake while Hillhouse, which subscribed to $11.81 million in the deal, owns 8.49 percent to become the third-largest shareholder, shows the filing.

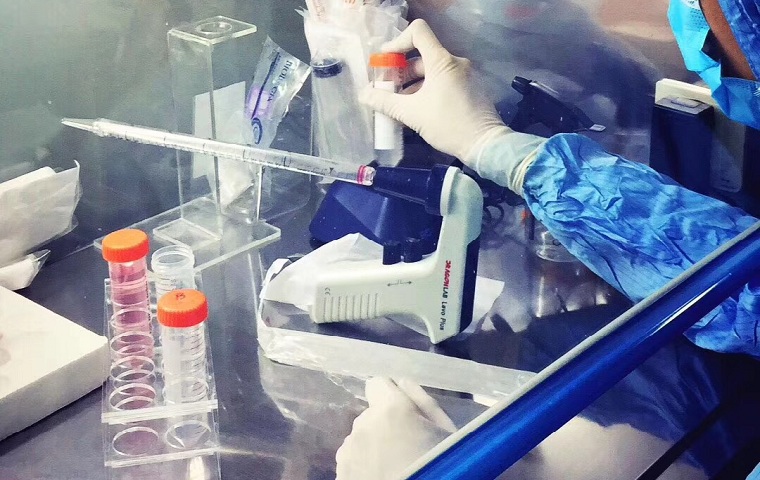

The transaction is expected to promote the R&D and commercialization of Zerun's human papillomavirus (HPV) vaccines.

Zerun, incorporated in 2003, specializes in prophylactic vaccines for major infectious diseases and therapeutic vaccines. The company was acquired by Walvax in May 2013.

The HPV infection is the main cause of cervical cancer, the early vaccination of HPV vaccines can effectively prevent cervical cancer. At present, the market of HPV vaccines is far from saturated. Zerun's main products are Cervarix and Gardasil9, its main founder Dr. Shi Li has worked in the leading enterprise Merck in the US for 13 years.

About Hillhouse Capital Group (Hillhouse)

Hillhouse is a long-term fundamental equity investor. The company owns companies across equity stages, spanning the range from new start-ups to the world’s most established public companies. It invests globally, with a particular focus on Asia. The team members of the company are sector experts in consumer, Internet, media, and healthcare.

About Yingke Innovation Asset Management (Yingke Capital)

Founded in 2010 by Mingfei Qian and headquartered in Fuzhou, China, Yingke Capital is a principal investment firm specializing in pre-IPO investments. It seeks to invest in 5G internet of things, biomedical, environmental and facilities services, new energy, consumer upgrade, smart manufacturing, and materials sector.

Yingke Capital prefers to invest in companies with high technology R&D and production capacity.

提供支持

提供支持