According to iivd.net, Matridx, a Hangzhou-based biotechnology company, has announced the completion of its Pre-A Round of about 100 million yuan, with participation from Proxima Ventures, Puhua Capital and other investors focusing on In vitro diagnosis industry. The funds raised will be used for the registration and certification of related equipment and kits of mNGS (metagenomic Next-Generation Sequencing) for metagenomics pathogen detection, and the construction of the service network.

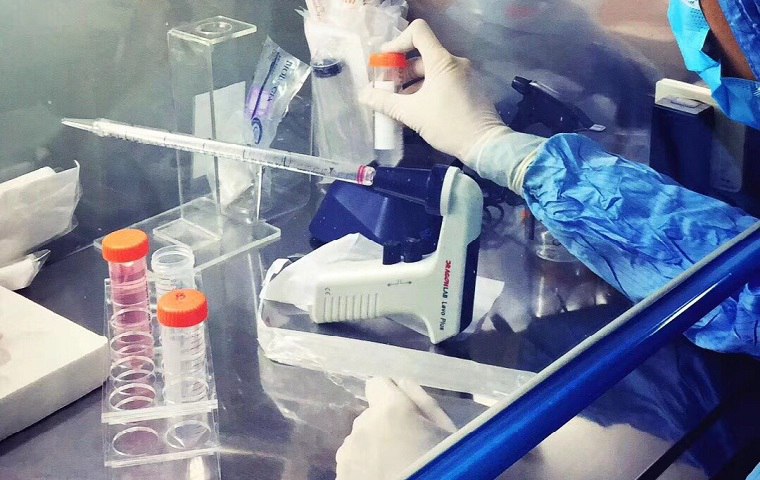

Matridx was co-founded by Dr. Wang Jun, one of the founding team members of Berry Genomics and Mr. Zhong Jie, the original partners of the Zhejiang Grand Health Industry Equity Investment Fund. As a technology platform based on NGS (Next-Generation Sequencing) and gene editing by CRISPR(Clustered Regularly Interspaced Short Palindromic Repeats) /Cas (CRISPR-associated), Matridx is committed to the innovation of infectious disease testing.

Matridx is a strategic partner of Alibaba Cloud for AI applications in infectious diseases and the only Chinese firm providing the automatic mNGS detection solution.

Dr. Wang Jun, CEO of Matridx, said, "Currently, our mNGS products have been used in the main battlefield of coronavirus in China, and we are working with the first-line anti-epidemic medical staff to save the lives of more patients. We will also cooperate with qualified ICL (Independent Clinical Laboratories) to promote the application of mNGS."

About Proxima Ventures

Proxima Ventures focuses on the healthcare industry, supporting outstanding enterprises with innovative technologies or service models that have tremendous potential. They manage multiple funds in RMB and US dollar, covering from seed to growth stages. Proxima Ventures has built 5 transform centers to build and grow healthcare ventures. It has Invested in 23 companies with multiple solutions to patients and been working hard on 36 diseases.

About Puhua Capital

Puhua Capital is an equity investment firm that focuses on the early and middle project. The company provides the required resources and management experience for the invested enterprise, investing funds and more resources and wisdom. Puhua Capital has invested nearly 300 excellent start-ups.

提供支持

提供支持